Ethereum (ETH) price action finally sparked some hope charting 2% gains on Monday, but can ETH price hold above the $1,300 mark?

The crypto market reversed some of the losses over the weekend, with Bitcoin price battling the $19,000 mark. Ethereum price moved in tandem with BTC short-term gains as ETH saw itself above the $1,315 mark on Monday.

ETH Price Gains Ground

On a daily chart, ETH price noted a considerable uptick, placing price above the $1,315 resistance mark. Daily Relative Strength Index crossed over to the buyers dominating side, presenting a bullish narrative for ETH.

A healthy uptick in daily RSI presented buyers overshadowing sellers in the market as buying pressure developed steadily. In tandem with the rising buying pressure as well as short-term gains, a considerable amount of ETH short contracts were liquidated.

Data from Glassnode highlighted that futures contracts short liquidations reached a one-month high of $2,883,883 on Binance. Ethereum’s mean liquidated volume in futures contracts short positions also made a one-month high of $239,642.08 on Binance.

Additionally, Ethereum number of addresses in profit (7D MA) reached a one-month high of 45,770,599, finally spelling some relief for ETH HODLers.

Whales and Big Players Still in Doubt

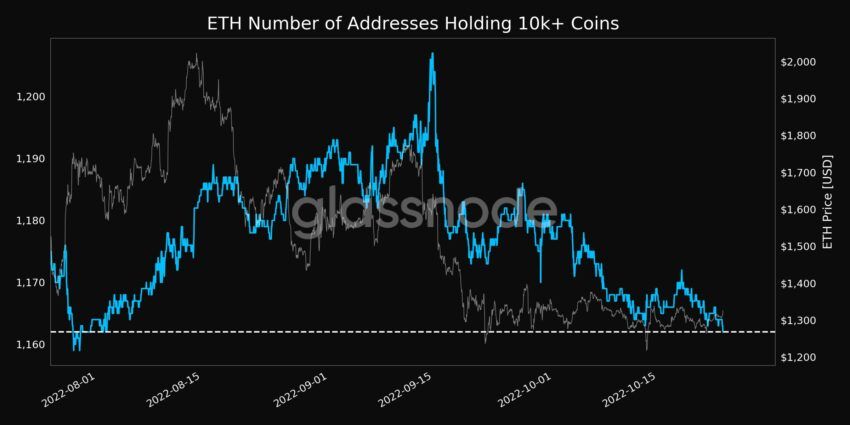

While the sentiment in the futures market turned slightly bullish larger entities still presented some doubt. Notably, the number of addresses holding 10k+ coins just reached a one-month low of $1,162, despite the weekend gains and short liquidations.

A look at ETH’s supply distribution by the balance of addresses also showed that even though price appreciated in the short-term, addresses holding a higher number of coins still trended low.

ETH’s staking returns have also not been as significant as expected because of lower-than-expected Maximal Extractable Value (MEV) and tips in this bear market. As per data from Messari, the increase in real returns from 0% to 6% is much more tangible, as ETH inflation has fallen to near zero from 4%.

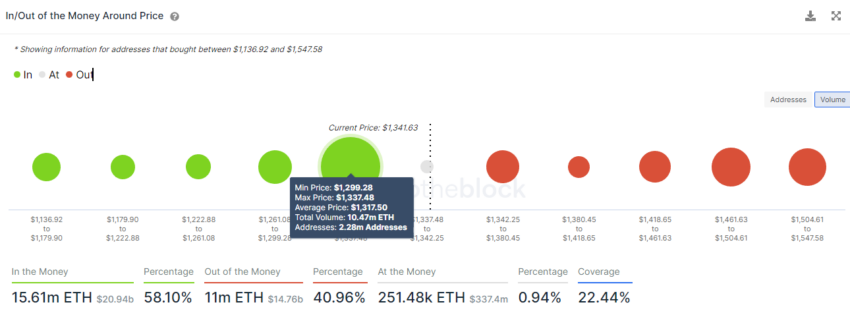

Going forward, ETH’s price would need to maintain above the $1,317 mark as 10.47 million ETH is held by close to 2.28 million addresses. A fall below the $1,317 price level can trigger some sell-offs for the cohort leading to short-term losses.

While short-term gains triggered short liquidations and a slightly bullish futures market sentiment, the larger tone was still bearish. In case of a bullish reversal, ETH price can rise to above $1,350, where ETH’s next key resistance is placed.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Be the first to comment