Online payments company PayPal has posted a net revenue of $6.85bn for the third quarter, beating the market’s expectation of $6.82bn. The strong revenue means that digital payments services are still growing, which could potentially be a bullish sign for crypto.

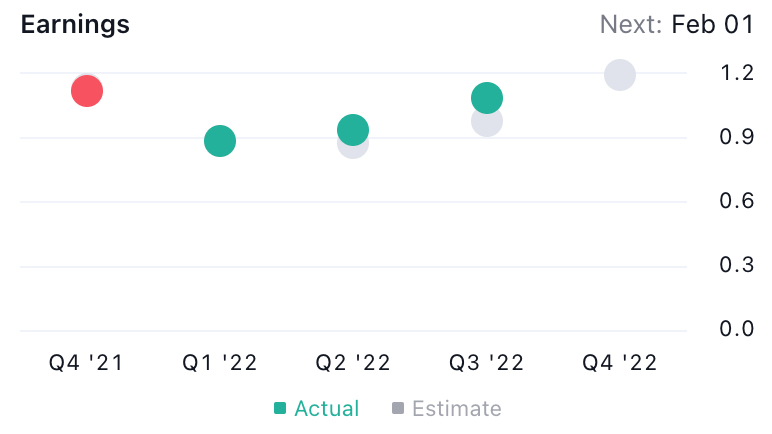

The revenue by the payments giant was up 11% year-over-year, while earnings per share (EPS) increased by 26% to $1.15, compared to an estimate of $0.96, according to the company’s earnings report.

PayPal also said in its earnings report that total volume of payments was up 9% quarter-over-quarter to $337 billion for the period. PayPal’s subsidiary Venmo accounted for $63.6 billion of the quarterly figure, the report said.

Despite the strong earnings report, PayPal shares traded lower on Friday, falling more than 5% before later trimming some of their losses. At the time of writing at 18:40 UTC, the stock traded at $73.17, down sharply from $83 just three days ago.

The bearish price action for the PayPal stock stood in sharp contrast to the action in the bitcoin market, where prices surged on Friday to over $21,300, before falling back again to the $20,800 area.

At press time, bitcoin was up a strong 3.5% for the past 24 hours to trade at $20,977.

The difference in performance between the two assets is notable given that PayPal is still seen as a tech stock, and tech stocks have in recent years generally been correlated with bitcoin. With bitcoin now outperforming the stocks like PayPal, however, the question of whether a decoupling is underway between the two asset classes arises.

Whatever the case is, the strong trading in both BTC and ETH on Friday shows that investors are still willing to take on risk in the crypto markets, despite a still hawkish tone from the Fed – potentially a very bullish sign for the time to come for crypto investors.

Be the first to comment