India’s central bank governor has once again expressed skepticism toward cryptocurrencies, saying these assets are “nothing but gambling” and asking for a blanket ban.

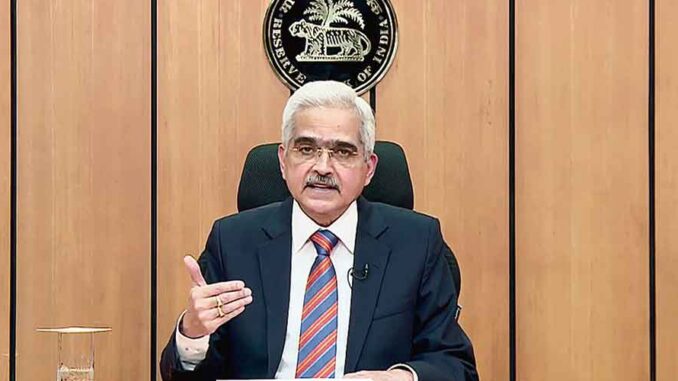

Speaking at a Business Today event, Shaktikanta Das claimed cryptocurrencies don’t have any intrinsic value and their perceived “value is nothing but make-believe.” He said cryptos are not even a tulip, alluding to the well-known Dutch tulip mania blow-up in the early part of the past century.

“Every asset, every financial product has to have some underlying (value) but in the case of crypto there is no underlying… not even a tulip…and the increase in the market price of cryptos, is based on make-believe.”

Das added that crypto is “100 per cent speculation or to put it very bluntly, it is gambling.” He then argued that since gambling is banned in India, cryptos should not be allowed too — or the government should lay the rules for gambling.

Another reason why the Reserve Bank of India (RBI) should ban crypto is that they pose a threat to central banks, Das said, noting that if cryptos gain mainstream adoption, they would impact central banks’ ability to decide on monetary policy. He said:

“Please believe me, these are not empty alarm signals. One year ago in the Reserve Bank, we had said this whole thing is likely to collapse sooner than later. And if you see the developments over the last year, climaxing in the FTX episode, I think I don’t need to add anything more.”

On the other hand, Das expressed his support for Central Bank Digital Currencies (CBDCs), calling them “the future of money.” As reported, India started a pilot program of its digital currency in cooperation with nine banks in November last year.

Despite its push for a CBDC, the RBI has long maintained a harsh stance toward digital assets, arguing that the nascent asset class has no underlying value. The central bank has constantly warned investors and the government against crypto, citing volatility as well as risks of fraud and scams.

In July last year, the RBI asked the Indian government to ban cryptocurrencies in the country, citing the “destabilizing” effect of this asset class on monetary stability.

India, which currently holds the G20 presidency, also plans to use this opportunity to coordinate global crypto regulation. As reported, India’s federal economic affairs secretary Ajay Seth said in December last year that the G20 countries will study the implications of cryptocurrencies for the economy, monetary policy, and the banking sector in order to inform a policy consensus.

Be the first to comment