Polygon appears to have peaked at $1.54 in mid-February before retracing 27%. Still, on-chain data shows that the bottom might be close, as MATIC short-term traders have begun to ease sell pressure.

Polygon is a Layer-2 (L2) scaling solution touted as a solution to Ethereum’s throughput issues and punitive gas fees. Despite Ethereum’s successful transition to proof-of-stake (POS) and network upgrades, crypto investors raised concerns over the long-term viability of the Polygon ecosystem.

Polygon Doesn’t Lose Traction Despite Upcoming Ethereum Shanghai Upgrade

Still, Polygon’s faster transaction speeds and strategic partnerships to expand the ecosystem appear to yield network growth dividends.

A closer look at crucial on-chain data shows that despite the recent 27% correction, Polygon has not lost considerable traction. According to Santiment, the number of Daily Active Addresses on the Polygon network has increased in the last 30 days.

The number of active users on the Polygon network grew from 150,000 to 175,000 between February 5 to March 6. Typically, a surge in traction indicates an increase in underlying demand for services hosted on the network.

Another key detail is the positive divergence between the recent MATIC Price downtrend and the spike in Daily Active Addresses. As observed between December 2021 and January 2022, such divergence can be an optimistic signal for an impending price rally.

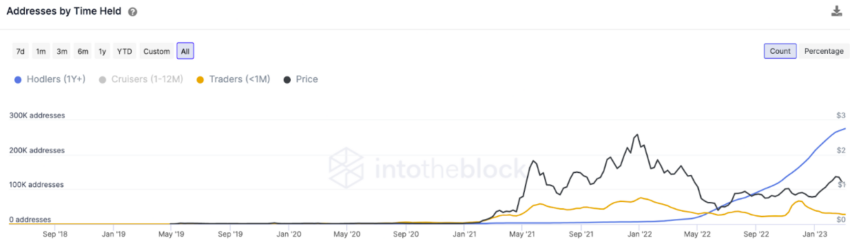

MATIC holders have endured a 27% retracement since mid-February. Critical on-chain data by IntoTheBlock suggests crypto investors are looking to end the MATIC sell-off and position for future gains.

The number of short-term traders has declined by nearly 3,000 addresses between February 6 and March 6. At the same time, the number of addresses that have held MATIC for at least one year has surged by 17,000.

This bullish signal means short-term traders are closing out their position while long-term investors appear to be holding out for future gains.

MATIC Price Prediction: Is the End of the Correction Near?

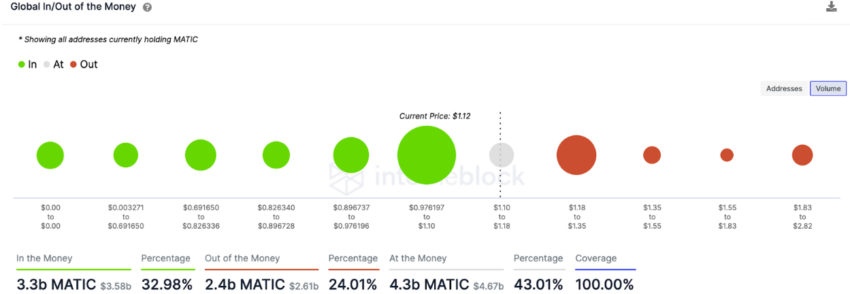

The Global In/Out of Money data, which shows the distribution of MATIC holders around the current prices, also corroborates the bullish perspective.

At the current prices, only 33% of holders are in profit, which indicates significant room for growth as those out of money are unlikely to sell at huge losses.

If MATIC can scale the $1.25 resistance, where 42,000 addresses hold 1.5 billion tokens, it could rally toward $1.85. The next significant resistance with nearly 100,000 addresses holding 230 million MATIC.

In contrast, $0.93 will be the target support point if things take a bearish turn. However, if the 88,000 addresses holding over 5 billion MATIC tokens at an average of $0.93 cannot stop the bears, MATIC may decline towards $0.78, where 58,000 addresses are holding 760 million tokens.

Sponsored

Sponsored

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Be the first to comment