Bitcoin’s recent price movement has dived to the $27,000 level, sparking concerns among traders and investors.

As the market sentiment shifts, all eyes are now on a crucial support level at $26,600.

The cryptocurrency’s ability to hold this support level will determine its next move and could potentially set the tone for the near-term price action.

In this Bitcoin price prediction, we delve into the factors influencing the market and analyze the significance of the $26,600 support level.

EU Officials Enact MiCA Framework into Law

The European Union (EU) has officially signed into law a bill known as the Markets in Crypto-Assets (MiCA) framework. Introduced in 2020, the bill aims to establish a robust regulatory framework for crypto assets within the EU region.

After receiving approval from finance ministers, the bill was signed by Peter Kullgeren, the Minister of Sweden for rural affairs, and Roberta Metsola, the European Parliament President, on May 31st.

Over the course of three years, the MiCA Framework underwent thorough discussions and deliberations among EU lawmakers before reaching its final approval.

The framework aims to create a unified regulatory environment for crypto assets across EU member states.

The law will come into effect in 2024, marking the beginning of regulation for crypto firms operating within the EU region.

Crypto Anti-Money Laundering Guidance to Take Effect in UAE in June

On May 31st, the UAE Central Bank announced the introduction of new guidance concerning anti-money laundering (AML) measures for virtual assets, cryptocurrencies, and NFTs.

The focus of this guidance is to ensure that financial institutions operating in the UAE adhere to AML and CTF (Counter Terrorism Financing) measures.

The Central Bank of UAE acknowledges the potential risks of virtual assets and their service providers.

The bank emphasizes the importance of implementing due diligence procedures for regulated financial service providers when dealing with customers involved in cryptocurrencies and NFTs.

The new regulations will come into effect in June. They will apply to various institutions, including banks, payment service providers, exchange houses, finance companies, insurance companies, brokers, hawala providers, and agents.

The primary objective is to implement measures that prevent illicit activities such as terrorist financing and money laundering.

The new guidance aligns with the standards set by the Financial Action Task Force (FATF) and incorporates them into the regulatory framework of the UAE.

Justin Sun’s Comments Helped Bitcoin Stabilize Amidst Downfall

Justin Sun, the founder of Tron, recently expressed his approval of the decision to allow retail investors in Hong Kong to engage in virtual currency trading starting from today.

He viewed this as a significant milestone for China’s crypto industry, which has been known for its restrictive stance towards digital assets.

Sun’s remarks were about the recent announcement from Hong Kong, which will permit retail traders to buy and sell cryptocurrencies as the country repositions itself as a digital asset hub.

However, companies seeking involvement in this new initiative must obtain licenses under the new regulations.

According to Sun, one remarkable aspect of Hong Kong’s policy is that Chinese residents can also participate in retail crypto trading on Hong Kong exchanges, expanding the exposure of the crypto market to mainland China.

These comments from Justin Sun provided some support for Bitcoin on Thursday and helped limit further declines in its price.

Bitcoin Price Prediction

Bitcoin is currently priced at $26,858 as of June 1st, showing a decrease of nearly 1%% in the past 24 hours.

The leading cryptocurrency has continued its downward movement for the fourth consecutive session, reflecting a bearish trend.

This comes as the broader cryptocurrency market experiences mixed sentiments.

Bitcoin’s price is displaying a slightly bearish trend, hovering around the 26,850 level.

Analysis of the four-hour timeframe reveals that Bitcoin has already reached the 78.6% Fibonacci retracement level and subsequently declined toward the next support level at 26,650.

The significance of this support level was discussed in our previous update, as its breach could potentially trigger a bullish reversal in Bitcoin’s price.

The presence of a bearish engulfing candlestick formation below the 50-day exponential moving average suggests that bears are currently dominating the market sentiment.

Nevertheless, as long as the price maintains its position above the 26,600 level, there is a possibility of a reversal in the trend.

This could lead to a potential upward move, targeting resistance levels at 27,300, 27,500, or even 28,000.

On the downside, if Bitcoin breaks below the 26,600 support level, the next target for sellers could be around 26,000.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

Prepare yourself for an enticing selection of cryptocurrencies carefully chosen by Cryptonews and Industry Talk for their potential in 2023.

Get ready to dive into a realm of thrilling possibilities and captivating opportunities that await in the realm of these digital assets.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

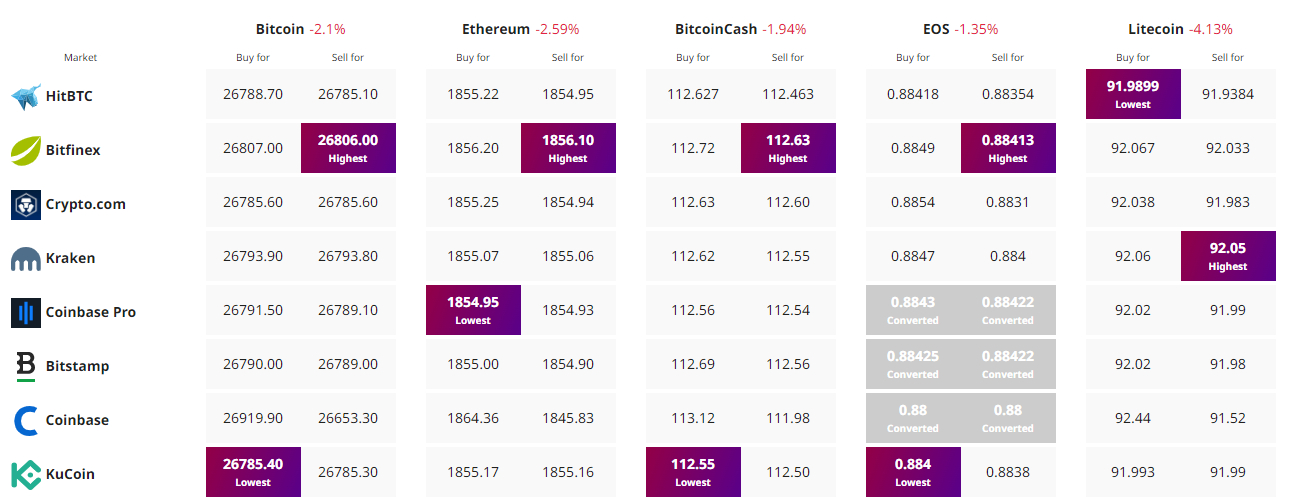

Find The Best Price to Buy/Sell Cryptocurrency

Be the first to comment