Key Takeaways

Decentraland has risen by more than 128% since May 12.

Meanwhile, SandBox saw its price increase by 60%.

MANA and SAND remain on shaky grounds despite the recent gains.

Share this article

Decentraland and Sandbox have recovered from the downswing seen on May 12. Still, these tokens have yet to collect enough liquidity to advance toward higher highs.

Decentraland and Sandbox Look Weak

Metaverse tokens MANA and SAND look primed for another downswing as trading volumes dry up.

Decentraland has enjoyed a significant rebound after printing a low of $0.6 on May 12. Since then, MANA surged more than 128% to reclaim the psychological $1 support level and recently hit a high of $1.37. Despite the impressive price action, it appears the token lacks the buying pressure to advance further.

MANA has reached the bearish target presented by a descending triangle that has developed on its three-day chart. But given the current market conditions, Decentraland could revisit the recent lows at $0.6 before collecting enough liquidity to advance further.

A sustained three-day close below the $1 support level can serve as confirmation of the pessimistic outlook.

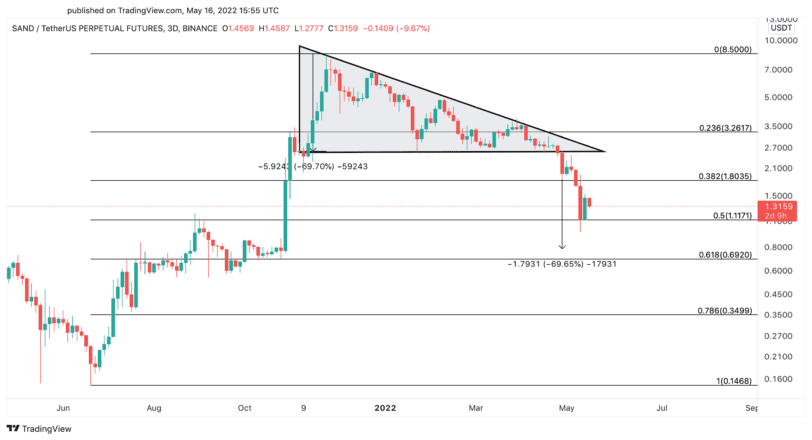

Sandbox also looks like it could dip below $1 again. Although SAND surged by nearly 60% after hitting a low of $0.96 on May 12, it has yet to meet the bearish target presented by a descending triangle that developed on its three-day chart.

Further selling pressure could see the Metaverse token slice through the $1.12 support level to reach $0.70.

It is worth noting that a spike in buying pressure around the current price levels could help Decentraland and Sandbox invalidate the pessimistic outlook. MANA would have to claim $1.48 as support to encourage sidelined investors to reenter the market and push its price to $2. Meanwhile, SAND would have to slice through the $1.80 resistance level to surge toward $3.26.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

For more key market trends, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Be the first to comment