Ethereum faced a significant setback last week, with its price plummeting to a seven-month low. Interestingly, the price decline coincided with the blockchain network total gas fee dropping to a three-year low.

Over the past week, the broader crypto market experienced more volatility amid the ongoing war between Israel and Palestine over the Gaza Strip.

ETH Price Drops to a 7-month Low

During the period, ETH’s value saw a 6% decline, falling to around $1,520 as the Ethereum Foundation and major whale addresses dumped the asset.

On October 9, the Foundation swapped approximately 1,700 ETH worth $2.7 million for the USDC stablecoin.

Ali Martinez, BeInCrypto’s global head of news, revealed that ETH whales have offloaded more than 5 million ETH, equivalent to roughly $8.5 billion, since February.

Meanwhile, market observers suggest that the declining price movement indicates diminishing investor interest in Ethereum.

Google searches for the asset have reached their lowest point since 2020, reflecting declining public curiosity.

Moreover, investor enthusiasm for Ethereum-related investment products has remained lukewarm despite the launch of several futures exchange-traded funds.

Nevertheless, some experts maintain optimistic forecasts, predicting a potential fivefold increase in Ethereum’s value by 2026.

Ethereum Gas Fee Crashes

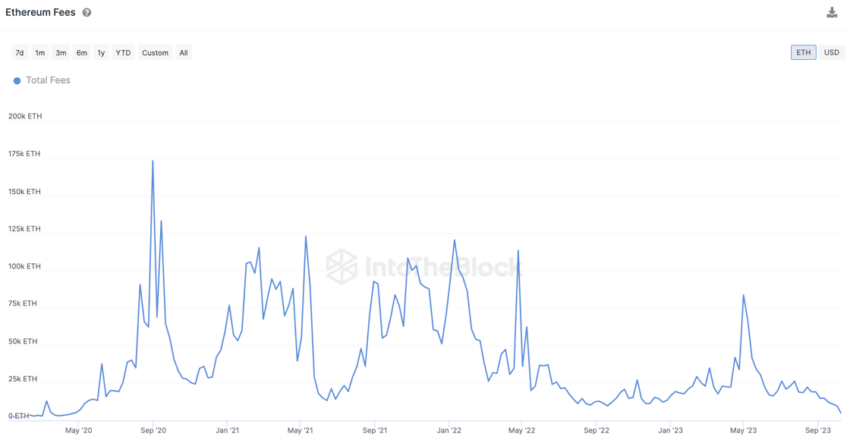

In a separate development, Ethereum’s gas fees have recently hit a three-year low, according to a report by IntotheBlock.

This data corroborates a previous BeInCrypto report that stated that Ethereum’s network fees have dropped to a yearly low. According to the report, the fall can be attributed to a recent decline in the network’s on-chain activity.

IntoTheBlock also shares this sentiment, pointing out that “this decrease is driven by the migration to layer 2s and the decreasing usage of applications in Mainnet.” It added:

“As speculative activity on L1 disappears and L2s continue to grow, Ethereum fees are likely to remain low. The upcoming introduction of EIP-4844 may further accelerate this trend as it is expected to decrease L2 fees by an order of magnitude.”

Historically, Ethereum gas fees have been relatively high due to extensive on-chain activity. However, the fee fell to its lowest since April 2020, marking a substantial 90% reduction from its May peak.

Meanwhile, these concurrent developments raise questions about the future trajectory of Ethereum as its market performance and transaction costs experience significant shifts.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Be the first to comment