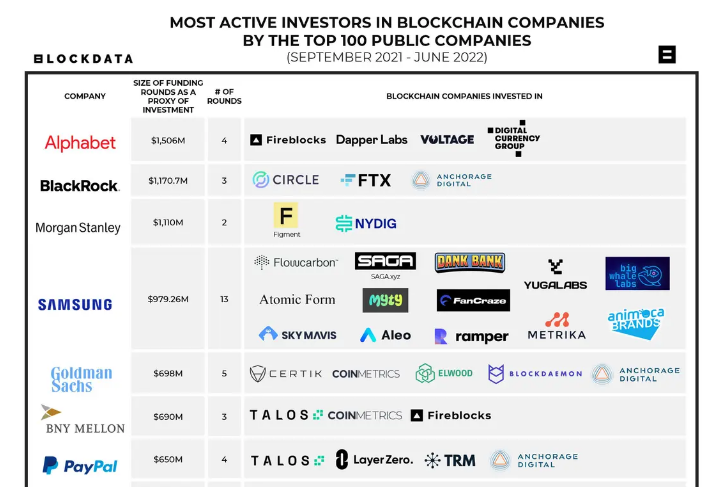

Between September 2021 and mid-June 2022, Samsung invested in 13 crypto/blockchain companies thus making the South Korean corporation the most active among the top 40 corporations. Google’s parent Alphabet firm, on the other hand, tops the category of top corporations that participated in the biggest funding rounds.

40 Corporations Invest $6 Billion

According to the research firm Blockdata’s analysis of investments in blockchain and crypto startups by top corporations between September 2021 and mid-June 2022, the South Korean electronics giant Samsung was the most active having invested in 13 companies. United Overseas Bank, which invested in 7 companies is the next most active and is closely followed by two American financial services giants Citigroup (6) and Goldman Sachs (5).

As shown by the analysis, the number of crypto or blockchain startups funded by Samsung, United Overseas Bank, Citigroup and Goldman Sachs in the period under review is nearly half (31) of the total number of startups (65) that raised capital from the 40 top corporations.

While the data on the exact amount invested by each corporation is unavailable, Blockdata’s analysis still gives an estimate of the amount that was invested by all the corporations.

“The 40 companies invested approximately $6 billion into blockchain startups between September 2021 and June 2022. Because some rounds involve participation from multiple investors, it is unclear how much each company invested in a project,” reads Blockdata’s research report.

Meanwhile, concerning corporations that were active in the biggest funding rounds, Alphabet, the parent company of Google, tops this category after it participated in rounds that raised just under $1.51 billion. Blackrock is in second place having participated in three funding rounds in which $1.17 billion was raised.

The American financial services giant Morgan Stanley occupies the third spot having participated in two rounds which garnered $1.1 billion while Samsung is in fourth place with $979 million.

Corporations Invest in NFT Companies

Concerning the use cases that top corporations are interested in, Blockdata determined that 19 of the companies receiving funding were in “some form of non-fungible tokens (NFT) solutions and services.” Twelve are marketplaces while eleven are in the business of providing gaming services.

Explaining the different investment approaches by the top corporations, the research firm said:

Samsung is placing bets across the blockchain ecosystem investing in companies focused on 15 different use cases, such as blockchain services, development platforms, NFT, and social networks. On the other hand, Alphabet and Blackrock are showcasing a completely different strategy by making concentrated bets on a smaller set of companies.

What are your thoughts on this story? Let us know what you think in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Blockdata,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Be the first to comment