As the market capitalization of the stablecoin tether nears $80 billion, with its current $77.9 billion valuation, data from onchain researchers at Santiment indicates that tether addresses valued at $1 million own more than 80% of the entire supply.

Tether’s Whales Command More Than 80% of the Supply

The U.S. dollar-pegged stablecoin has grown exponentially during the last few years and according to today’s metrics there’s 77.9 billion tether (USDT) in circulation today. Tether is the most dominant stablecoin out of all the stablecoins in existence in terms of market capitalization.

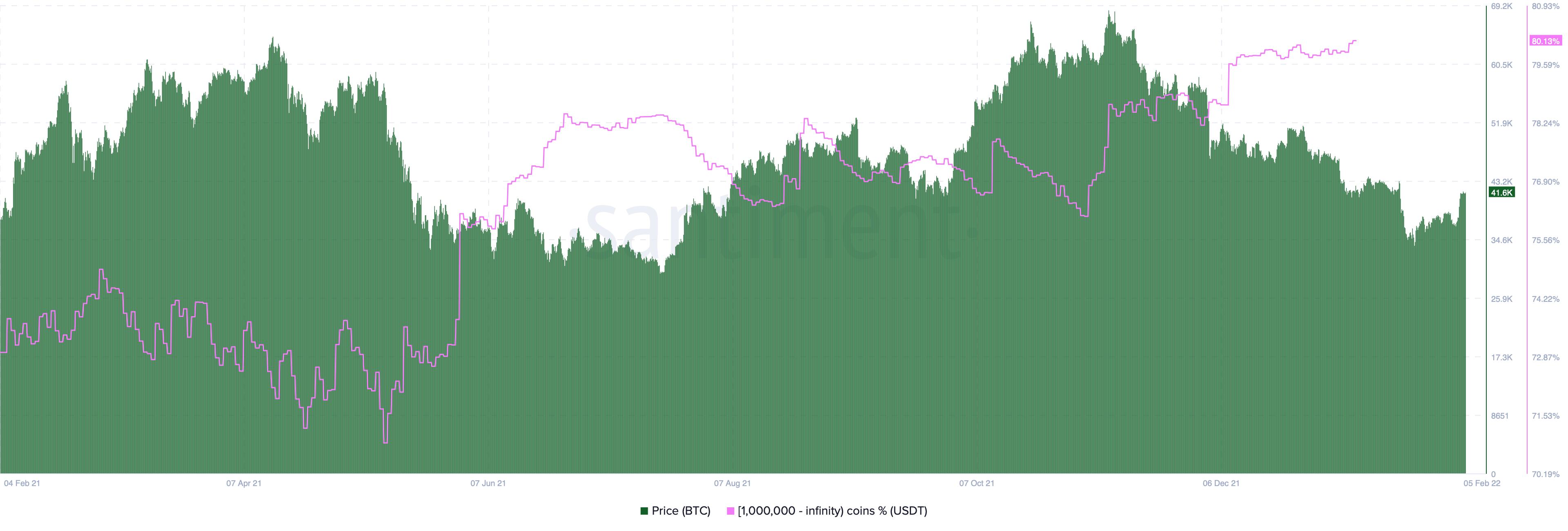

USDT’s market capitalization of $77.9 billion further represents 3.79% of the $2 trillion crypto economy. Furthermore, recent data from Santiment shows that USDT’s concentration of larger holders valued at $1 own more than 80% of the entire supply.

“Tether’s addresses valued at $1M are on the cusp of returning to owning 80%+ of $USDT’s supply for the first time in 3 weeks,” Santiment tweeted. “Generally, whale stablecoin addresses increasing their buying power is a good prospect for crypto’s long-term future.”

At the time of writing, Santiment’s metrics show USDT addresses valued at $1 million command 80.13% of the 77,922,851,073 tether supply in circulation. Into the Block indicates that the concentration of large tether (USDT) holders today is 46%.

The Ethereum-based USDT rich list stemming from coincarp.com shows there are 4.4 million ETH addresses holding tether. The top ten USDT holders own 28.4% of all the ERC20 tethers in circulation while the top 100 commands 47.71%.

Stablecoins USDC and UST Have a Significant Concentration of Large Holders

While Santiment’s USDT data shows that USDT addresses valued at $1 million command 80.13%, USDC statistics indicate that USDC addresses valued at $1 million command 86.8% of the stablecoin’s supply.

USDC has approximately 51,570,858,520 U.S.-dollar-pegged tokens in circulation today. Into the Block’s concentration of large USDC holders also shows the metric is higher than USDT’s at 63%.

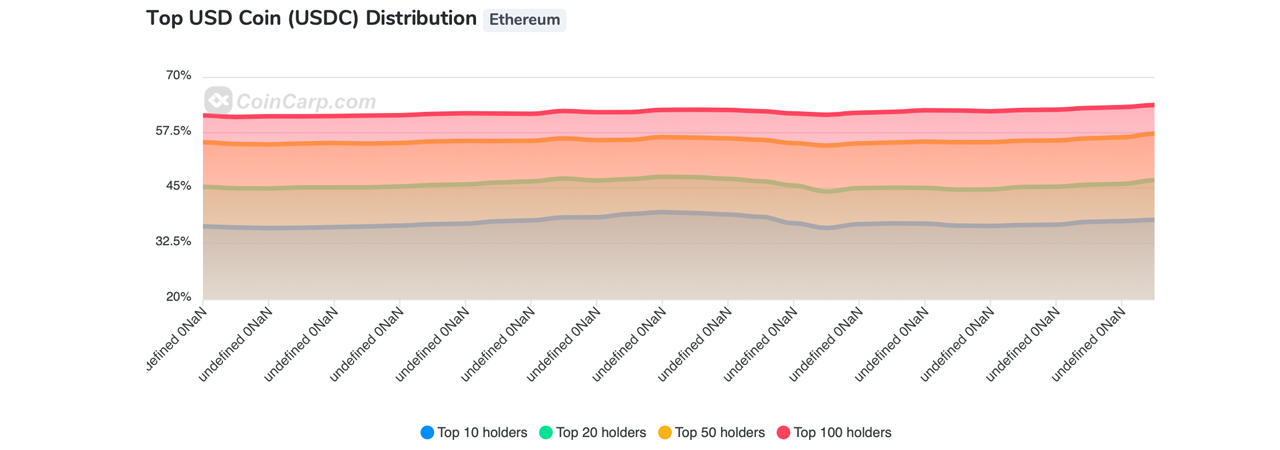

Coincarp.com’s USDC rich list metrics show the concentration of holders leveraging USDC on the Ethereum network. Currently, there are 1.35 million ETH addresses holding USDC and the top ten addresses holding the most USDC command 38.11% of the circulating supply.

Moreover, the top 100 USDC ETH-based addresses own 63.79% of the stablecoins on that specific chain. Terra’s UST also has a large concentration of holders according to Santiment’s UST data.

Data concerning Terra’s UST stablecoin (UST issuance on Ethereum) recorded by coincarp.com indicates that ten ethereum-based addresses hold 73.77% of the UST supply. Of course, this data is based on EVM-based UST and the 28,737 holders.

The top 100 UST stablecoin addresses on Terra hold 97.70% of the coins in circulation. Coingecko.com data shows there’s approximately 11,256,872,859 UST in circulation on February 8, 2022. At the same time, EVM-based UST stands at 947.5 million in circulation today.

While there is $179 billion worth of fiat-pegged tokens in existence today, stablecoins are not as liquid as circulation metrics suggest, especially when it comes to the concentration of large holders.

With the advent of stablecoin liquidity pools, many owners are simply holding stablecoins because they are less volatile and can accrue an annual percentage yield (APY) of up to 18% or more.

What do you think about the tether addresses that hold $1 million in coins commanding more than 80% of the supply? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Be the first to comment